Robinhood Markets (HOOD)

Robinhood: Advancing Toward New All-Time Highs

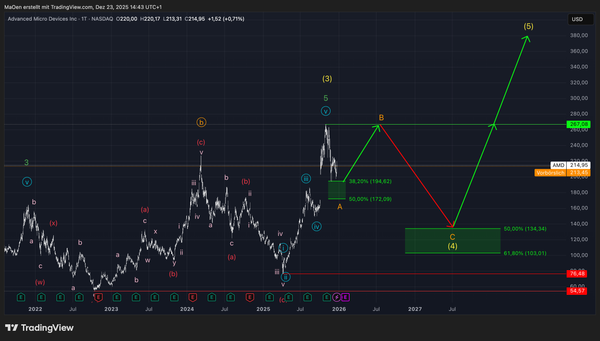

Since its IPO on July 29th, 2021, Robinhood Markets has remained trapped in a persistent bear market, continuously forming new cycle lows. However, on 20 November 2023 (yellow vertical line), the stock finally gained sustainable bullish momentum, initiating its first impulsive advance within the dark blue cycle, which produced light blue wave 1followed by a corresponding corrective light blue wave 2. This structure established the foundation for the unfolding light blue cycle.

From that point forward, the market developed a strong light blue wave 3, culminating in the stock’s current all-time high. After completing this third wave, Robinhood entered a sharp corrective phase, forming light blue wave 4.

We currently assess light blue wave 4 as already terminated and remain confident that the market has begun new impulsive movement into light blue wave 5, positioning itself to break above the existing all-time high and extend into fresh price territory. Light blue wave 5 represents the final sequence of the light blue cycle. Upon completion of this fifth wave, the entire light blue cycle is expected to transition into a higher-degree green wave 1, establishing a major top for the stock.

For this final impulsive sequence (light blue wave 5), we have projected a Fibonacci-based target zone that Robinhood is expected to reach once it breaks above the current all-time high at $153.86. This zone spans from the 61.8% extension at $188.50 up to the 100% extension at $241.88.

Within this price region, we anticipate light blue wave 5 to terminate, marking the completion of green wave 1.

Following the successful completion of green wave 1, we expect a larger corrective phase to unfold in green wave 2. After this upcoming long-term correction concludes, our long-term outlook calls for Robinhood to resume its bullish trajectory and begin a major advance in green wave 3.

Trading Plan:

We expect Robinhood Markets to break into new all-time highs and reach our projected Fibonacci target zone, where light blue wave 5 should terminate, completing the first sequence of the green cycle with green wave 1.

Once the market establishes this major top, we will provide a Fibonacci retracement zone in which we expect the bearish green wave 2 to conclude—offering new strategic buying opportunities ahead of the long-term bullish green wave 3.

We remain long-term bullish.

If any structural changes occur, or if Robinhood Markets reaches our projected price zone for a major top, we will update you immediately.

Kind regards,

Monalytics