Nvidia (NVDA)- Update

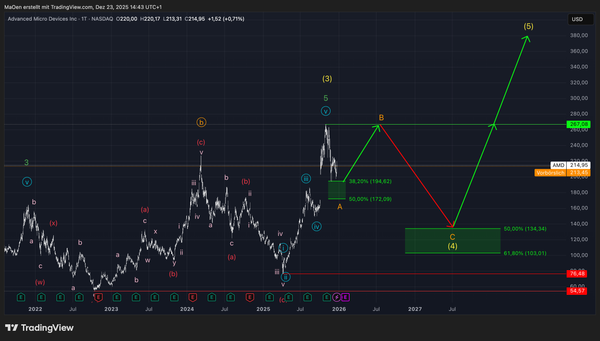

We have adjusted our Elliott Wave count while maintaining our original long-term expectation.

In our initial assessment, we anticipated that Nvidia had already topped and entered a large corrective phase, unfolding as a bearish long-term yellow wave 2. This interpretation has proven to be incorrect. Instead, Nvidia has altered its internal wave structure, requiring a revised count. Despite this structural change, the ultimate outcome remains unchanged.

Under the new count, we now expect Nvidia to register one final all-time high to complete long-term yellow wave 1.

At present, we assume that the corrective light blue wave 4 has already concluded and that the market has transitioned into impulsive price action, initiating light blue wave 5. For this fifth wave, we have defined a projected target zone using Fibonacci extensions. This zone spans from the 61.8% extension at $225.09 up to the 100% extension at $258.77.

Within this price range, we anticipate the formation of a significant long-term top, marking the completion of light blue wave 5, green wave 5, and ultimately yellow wave 1.

Trading Plan:

Should Nvidia reach our projected target zone, we expect a clear deterioration in bullish momentum and a broader shift from a bullish to a bearish market regime. As such, we view this zone as a high-probability area for selling or initiating short positions.

Our broader stance on this stock remains bearish.

If you have not reviewed our previous Nvidia analysis, we strongly recommend doing so for full contextual alignment. Should any structural changes emerge, or if price enters our anticipated target zone and triggers short-entry signals, we will provide an immediate update.

Kind regards,

Monalytics