Amazon EW Update

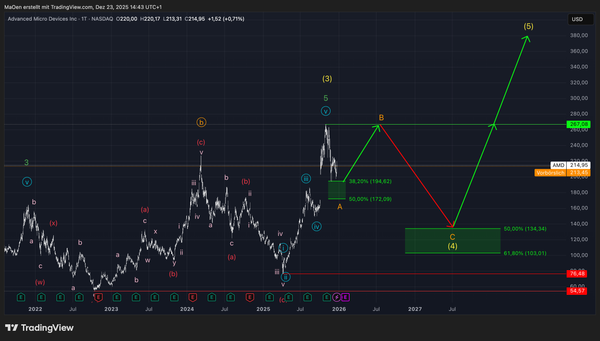

Amazon’s recent structural developments have unfolded rapidly, yet caution remains warranted at this stage. From an Elliott Wave perspective, we continue to expect that Amazon is still progressing within a corrective phase, specifically completing its light blue wave 4, which appears to be unfolding as a classic A–B–C correction.

However, an alternative scenario must be acknowledged. In this view, Amazon may have already completed light blue wave 4, thereby initiating a new impulsive advance to the upside, labeled as dark blue wave 1 (alt. (i)). Although this remains a valid possibility, we currently assign it a lower probability than our primary expectation.

Our main scenario suggests that Amazon is in the process of developing an extended orange wave B. Following the breakout above the former all-time high at $242.59 and the formation of a new high, the structure indicates a potential overshooting wave B pattern.

To capture this move technically, we have defined a Fibonacci target zone, where we expect bullish momentum to begin fading and a bearish reversal to emerge. This critical resistance area ranges between the 123.6% extension at $260.63and the 138.2% extension at $271.92.

Once price reaches this zone, we anticipate Amazon will start to lose upside momentum and begin a corrective declineinto the previously outlined Fibonacci target area, where orange wave C — and consequently light blue wave 4 — should complete. From this region, Amazon would be well-positioned to resume its larger impulsive uptrend.

Trading Plan

Our base expectation is for Amazon to approach the $260–$272 Fibonacci resistance zone before exhibiting clear signs of reversal. This area represents a strategic shorting opportunity, provided price action confirms weakening momentum. We emphasize that entries should only be considered once the market trades within this defined zone.

Important Note

Our analysis serves purely as market guidance based on Elliott Wave and Fibonacci principles. All trading decisions should be made at your own discretion and risk. We aim to highlight areas of potential market significance — the final decision remains entirely yours.